The world economy is changing—the people know, but their leaders don’t

China has been able to mobilize many other nations to resist and oppose United States and G7 policies in various global forums. The source of China’s remarkable economic growth—and the key to BRICS countries’ now successful challenge to the G7’s global economic dominance—has been its hybrid economic model

By Richard Wolff for Economy For All

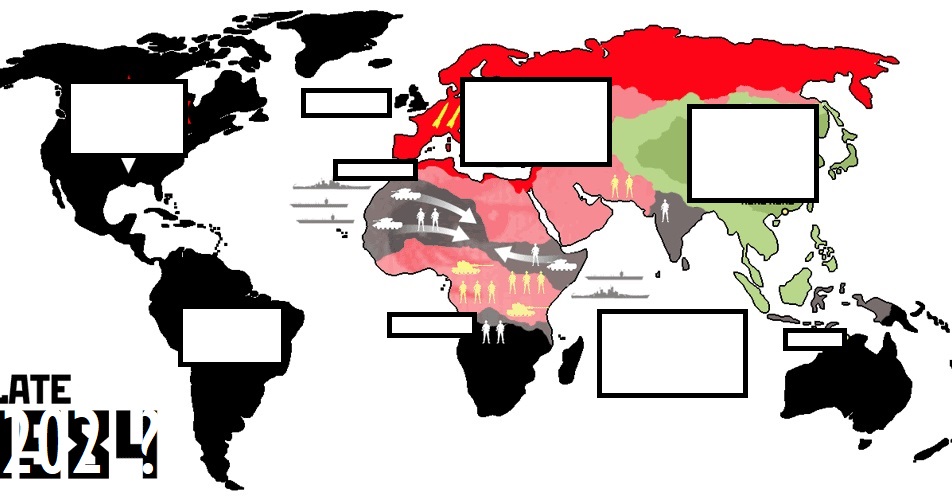

The year 2020 marked parity between the total GDP of the G7 (the US plus allies) and the total GDP of the BRICS group (China plus allies). Since then, the BRICS economies grew faster than the G7 economies. Now a third of total world output comes from the BRICS countries while the G7 accounts for below 30%. Beyond the obvious symbolism, this difference entails real political, cultural, and economic consequences. Bringing Ukraine’s Zelensky to Hiroshima to address the G7 recently failed to distract the G7’s attention from the huge global issue: what is growing in the world economy vs. what is declining.

The evident failure of the economic sanctions war against Russia offers yet more evidence of the relative strength of the BRICS alliance. That alliance now can and does offer nations alternatives to accommodating the demands and pressures of the once-hegemonic G7. The latter’s efforts to isolate Russia seem to have boomeranged and exposed instead the relative isolation of the G7. Even France’s Macron wondered out loud whether France might be betting on the wrong horse in that G7 vs. BRICS economic race just under the surface of the Ukraine war. Perhaps earlier, less-developed precursors of that race influenced failed US land wars in Asia from Korea through Vietnam to Afghanistan and Iraq.

China increasingly competes openly with the United States and its international lending allies (the IMF and the World Bank) in development loans to the Global South. The G7 attack the Chinese, charging them with replicating the predatory lending for which G7 colonialism was and G7 neocolonialism is justly infamous. The attacks have had little effect given the needs for such borrowing that drive the welcome offered to China’s loan policies. Time will tell whether shifting economic collaboration from the G7 to China leaves centuries of predatory lending behind. Meanwhile, the political and cultural changes accompanying China’s global economic activities are already evident: for example, African nations’ neutrality toward the Ukraine-Russia war despite G7 pressures.

De-dollarization represents yet another dimension of the now rapid realignments in the world economy. Since 2000, the proportion of central banks’ currency reserves held in US dollars has fallen by half. That decline continues. Every week brings news of countries cutting trade and investment payments in US dollars in favor of payments in their own currencies or other currencies than the US dollar. Saudi Arabia is closing down the petrodollar system that crucially supported the US dollar as the pre-eminent global currency. Reduced global reliance on the US dollar also reduces dollars available for loans to the US government to finance its borrowings. The long-term effects of that, especially as the US government runs immense budget deficits, will likely be significant... ...

Entire text is available at peoplesdispatch.org

Najnovije vesti

AKTUELNO

Umetnička zadruga u izgradnji: Radionica #1, 6 - 9. jun, Beograd

Saopštenje povodom poziva studenata fakulteta Univerziteta umetnosti u Beogradu